How Consultants Use Financial Data To Improve Business Performance

Consultants play a crucial role in improving business performance. They use financial data to guide decision-making and optimize operations. When you partner with experts, like San Antonio business consulting services, you gain insights essential for growth. These professionals analyze financial data to identify trends and patterns. You learn where your business excels and where adjustments are needed. Understanding revenue streams, cost structures, and cash flows can dramatically impact your bottom line. This knowledge helps you make informed choices about investments, resource allocation, and strategic planning. By digging deep into financial data, consultants reveal opportunities for increased efficiency and profitability. They help you streamline processes and reduce waste. This approach can lead to better performance. With these tools, your business can thrive. You can weather challenges and seize opportunities with confidence. By leveraging financial data, consultants empower you to build a stronger, more resilient business without unnecessary complexity.

Understanding Financial Data

Financial data is the backbone of any business. It includes all records of financial transactions. Sales figures, expenses, and profit margins are all part of this data. Consultants use these figures to paint a clear picture of a business’s financial health. By examining this data, they can pinpoint inefficiencies and suggest changes. This process is essential for businesses looking to enhance performance.

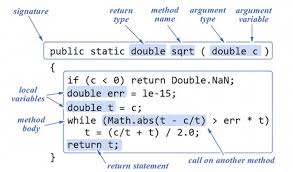

The Role of Analysis

Consultants apply various analytical techniques to financial data. These include trend analysis and ratio analysis. Trend analysis helps identify growth patterns over time. Ratio analysis, on the other hand, provides insights into liquidity and profitability. Together, these analyses help in crafting strategies that boost performance and competitiveness. For comprehensive resources on financial analysis techniques, refer to the Federal Reserve.

Identifying Opportunities for Growth

Financial analysis reveals opportunities that may not be obvious. Consultants identify underperforming segments and suggest ways to optimize them. For instance, they might discover a product line that has potential but lacks marketing. In such cases, reallocating resources can lead to significant improvements. This approach not only increases efficiency but also enhances customer satisfaction.

Comparison of Financial Metrics

| Metric | Use |

| Revenue Growth | Measures sales over a period |

| Profit Margin | Assesses overall profitability |

| Current Ratio | Evaluates liquidity |

Enhancing Decision Making

With accurate financial data, decision-making becomes more straightforward. Leaders can decide when to expand or cut back operations. Knowing the precise state of finances allows for confident planning. This strategic advantage is invaluable in today’s competitive markets.

Improving Resource Allocation

Effective resource allocation stems from properly understanding financial metrics. Consultants recommend where to invest or divest based on data insights. For example, if data shows high returns in one department, increasing its budget could enhance growth. This targeted allocation ensures maximum returns on investment.

Streamlining Operations

Reducing waste is a primary goal for any business. Consultants use financial data to identify areas of overspending. By adjusting these areas, businesses can save money and improve efficiency. This alignment between spending and earning is crucial for maintaining healthy growth.

Overcoming Financial Challenges

Businesses often face financial hurdles. Whether due to market fluctuations or unexpected expenses, challenges arise. With expert guidance and data-driven insights, businesses can navigate these challenges successfully. For additional information on overcoming financial challenges, visit the U.S. Small Business Administration.

Embracing Technology

Modern consultants use technology to enhance financial analysis. Advanced software helps in processing large volumes of data quickly. Automation tools streamline reporting and provide real-time insights. Embracing these tools is essential for staying ahead in a fast-paced business environment.

Conclusion

Consultants leverage financial data to transform how businesses operate. Through detailed analysis and strategic planning, they enhance performance and foster growth. By focusing on metrics that matter, businesses can achieve sustained success. Engaging with consultants who prioritize data-driven insights ensures you are well-equipped to handle any business challenge with resilience and clarity.