CommasMax Unveils Global Integrated Risk Control Network to Boost Transparency and Safety for Worldwide Traders

December 3, 2025 — CommasMax, a leading intelligent quantitative trading platform, has officially introduced its Global Integrated Risk Control Network, a major technical breakthrough aimed at enhancing real-time risk detection, transparency, and fund security for users across international markets.

This launch represents one of the platform’s most significant advancements, arriving at a time when competition in quantitative trading is intensifying and the demand for robust asset protection continues to rise. The new system is engineered to deliver a more stable trading environment, improved execution safeguards, and greater operational clarity.

Strengthening Security with a Non-Custodial, Transparent Framework

Founded in the U.S. in 2019, CommasMax has built its reputation around intelligent, automated trading strategies while strictly following a non-custodial model. Users maintain full control of API permissions and can revoke access whenever they choose.

The newly launched Global Integrated Risk Control Network reinforces the company’s core philosophy of Non-Custody + Shared Risk, making every step—from strategy execution and fund flow to risk monitoring—more visible and standardized. This minimizes systemic risks typically associated with custodial trading platforms and significantly reduces single-point vulnerabilities.

Institutional-Level Protection for Retail Users

The Global Integrated Risk Control Network features a network of multi-region monitoring nodes, a real-time strategy traceability system, and a full-link anomaly detection framework spanning markets in the Americas, Europe, and Asia-Pacific.

By analyzing market movements at the millisecond level and drawing from extensive multi-cycle historical data, the system delivers institutional-grade risk protection while ensuring users never have to hand over custody of their funds.

Built on Multi-Cycle, Real-World Performance

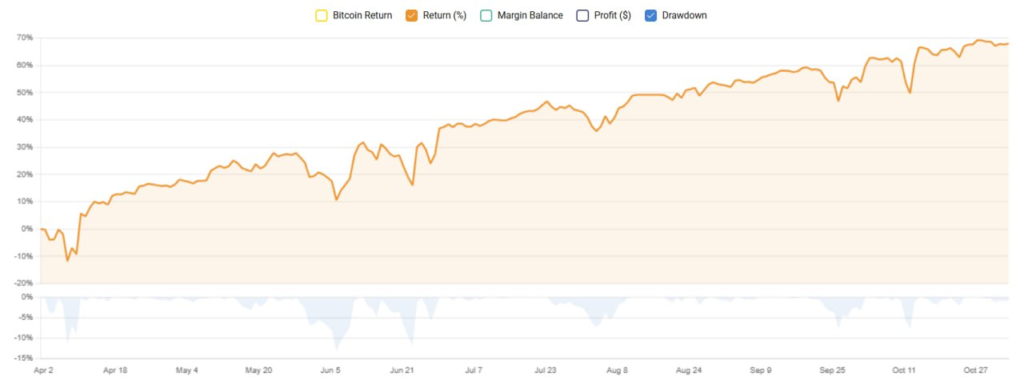

The upgrade is backed by years of proven live trading performance. CommasMax’s quantitative models have consistently demonstrated resilience through bull markets, bear markets, and periods of extreme volatility. Their stable strategic logic helps users avoid reliance on short-term momentum spikes and protects against catastrophic drawdowns.

This long-term performance data has been integrated directly into the architecture of the new Risk Control Network. As a result, the system can identify not only price-based risks but also strategy behavior deviations—creating a dual-layer risk protection framework.

Empowering Users with Full Autonomy

Industry experts highlight that combining a non-custodial structure with a global risk control network significantly enhances transparency and user empowerment. Traders retain complete control of their assets on major exchanges and authorize CommasMax only for executing trades—not for accessing or moving funds.

Users can pause strategies, revoke permissions, or intervene manually at any time. Through a shared-risk mechanism, CommasMax acts strictly as a strategy executor and risk monitor, maintaining zero involvement in asset custody.

Looking Ahead: Deeper Transparency & Advanced Monitoring

CommasMax plans to extend the coverage of its monitoring nodes and integrate more advanced analytical tools, including:

- abnormal trade pattern detection

- cross-exchange liquidity risk tracking

- permission-level security verification

- enhanced real-time strategy deviation analysis

The platform is also preparing to introduce partial risk data visualization features. These will allow users to independently review strategy status, exposure ranges, and risk interception logs—ensuring transparency is embedded throughout the entire trading lifecycle.

About CommasMax

Founded in 2019, CommasMax is an intelligent quantitative trading platform providing advanced automated trading strategies within a secure, non-custodial framework. Its goal is to make institutional-grade quantitative strategy execution and risk management accessible to retail traders around the world.

CoinsMax Trade Tech Ltd

Denver, United States